Mother Finance

နေ့စဉ် ငွေကြေးအခက်အခဲများ ပြေလည်စေရန် ချေးငွေများကို လွယ်လင့်တကူရရှိစေခြင်း

သက်သာသော အတိုးနှုန်း | ပုံသေကာလ | ယုံကြည်စိတ်ချရသော ချေးငွေ

MotherCredit®

MOTHERCREDIT® ကို ခရက်ဒစ်ရမှတ် စစ်ဆေးတာအတွက် ဘာကြောင့် အစားထိုး ရွေးချယ်ရလဲ?

ချေးငွေရယူနိုင်စွမ်းအတွက် ခရက်ဒစ်စစ်ဆေးမှုများသည် သင့်ဘဏ္ဍာရေး အခြေအနေ ကောင်းမွန်စေရန်အတွက် အရေးကြီးသည်ဟု ကျွန်ုပ်တို့ယုံကြည်ပါသည်။ ထို့ကြောင့် သင့်အား ဤ MotherCredit® ဝန်ဆောင်မှုကို ပေးဆောင်ရခြင်းမှာ ကျွန်ုပ်တို့၏ တွဲဖက်ကုမ္ပဏီ ဖြစ်သည့် Mother Finance Co., Ltd ၏ အခြေခံအကျဆုံးသောကဏ္ဍ တစ်ခု ဖြစ်ပါသည်။

MotherCredit® သည် သုံးစွဲသူ၏ ပြီးပြည့်စုံသော အပြုအမူဆိုင်ရာ ခွဲခြမ်းစိတ်ဖြာမှုကို အချိန်နှင့်တပြေးညီ ခိုင်ခိုင်မာမာ တည်ဆောက်ရန်အတွက် စမတ်ဖုန်း မက်တာဒေတာကို အသုံးပြုပါသည်။

MotherCredit® သည် သမားရိုးကျ ထုံစံဓလေ့အရ ခရက်ဒစ် အမှတ်ပေးနည်းစနစ်များကို အားကိုးခြင်းမပြုပါ။ ထို့ကြောင့် ရလဒ်အနေဖြင့်၊ ကျွန်ုပ်တို့၏ AI-based algorithm သည် ဖုန်းကိရိယာစက်ပစ္စည်း အထောက်အထားနံပါတ်၊ စာတိုပေးပို့ခြင်းဝန်ဆောင်မှု၊ လူပုဂ္ဂိုလ်အဆက်အသွယ်များ၊ တည်နေရာ၊ ဘရောက်ဆာမှတ်တမ်း၊ ပြက္ခဒိန်၊ အီးမေးလ်၊ ဖုန်းစက်တွင်းသိုလှောင်မှု၊ ဒေါင်းလုဒ်လုပ်ဆောင်ချက်များ၊ မိုဘိုင်းဒေတာအသုံးပြုမှု၊ အပလီကေးရှင်းအမျိုးအစားများ နှင့် ဖုန်းအသုံးပြုသူလှုပ်ရှားလုပ်ဆောင်ချက်များ စသည်တို့ကို စမတ်ဖုန်းမှ တဆင့်လေ့လာသိရှိနိုင်ပြီး ခန့်မှန်းနိုင်သော ပုံစံများအဖြစ်သို့ ပြောင်းလဲကာ ခရက်ဒစ် ရမှတ်သတ်မှတ်ပေးပါသည်။

MotherCredit® သည် သုံးစွဲသူများ၏ ခရက်ဒစ်ရမှတ်များကို တွက်ချက်ရာတွင် လူပုဂ္ဂိုလ်ကို ခွဲခြာသတ်မှတ်နိုင်မှု မရှိသည့် မက်တာဒေတာများကို အသုံးပြုပါသည်။ ထို့ကြောင့် General Data Protection Regulation (GDPR) အပါအဝင် ဒေသဆိုင်ရာ ဒေတာကိုယ်ရေးကိုယ်တာဥပဒေများကို အပြည့်အဝလိုက်နာမှု ရှိပါသည်။ ကျွန်ုပ်တို့၏ ရည်မှန်းချက်မှာ သုံးစွဲသူများ၏ ကိုယ်ရေးကိုယ်တာ အချက်အလက်များအား အကာအကွယ်ပေးရန်ဖြစ်ပြီး ၎င်းတို့အား ငွေကြေးအရ လက်လှမ်း�မှီမှု ရှိစေရန် ထောက်ပံ့ပေးရန် ရည်ရွယ်ပါသည်။ ကျွန်ုပ်တို့၏ MotherCredit® တွက်ချက်မှုသည် ရလဒ်ကို ၁ မိနစ်အတွင်း ထုတ်ပေးနိုင်ပါသည်။

သင်၏ ခရက်ဒစ်ရမှတ်ကို သိရှိခြင်းဖြင့် သင်၏ ဘဏ္ဍာရေးအခြေအနေကို ပိုပြီးနားလည်နိုင်ပြီး ချေးငွေခရက်ဒစ်ကတ်ကြွေးမြီနှင့် သင့်အိမ်ပေါင်နှံမှုတို့မှ မည်မျှချွေတာနိုင်သည်ကို နားလည်စေပြီး ခရက်ဒစ် ကို ပိုမိုတိုးတက်ကောင်းမွန်စေရန် ပြုလုပ်နိုင်မည့် ငွေကြေးကိစ္စဆိုင်ရာနောက်ထပ်ခြေလှမ်းများကို သိရှိစေ နိုင်ပါသည်။

Mother Finance App ကို

Download ရယူပါ။

သင့်ကိုယ်ပိုင်

အစားထိုးခရက်ဒစ်ရမှတ်ကို ရယူပါ။

စိတ်ကြိုက်ချေးငွေကမ်းလှမ်းမှုများနှင့်

အကြံပြုချက်များကို ရယူပါ။

အမေးများသောမေးခွန်းများ (FAQs)

ခရက်ဒစ်သည် ကုန်ပစ္စည်း သို့မဟုတ် ဝန်ဆောင်မှုတစ်ခုဝယ်ယူရန်အတွက် သုံးစွဲသူတစ်ဦး၏ ငွေချေးနိုင်သည့်စွမ်းရည်ဖြစ်သည်။ ဘဏ် သို့မဟုတ် အသေးစားငွေကြေးအဖွဲ့အစည်း သို့မဟုတ် ဘဏ်မဟုတ်သော ငွေကြေးအဖွဲ့အစည်းများ ကဲ့သို့သော ထောက်ပံ့သူများထံမှ ခရက်ဒစ်ကို ရယူနိုင်ပါသည်။ ထိုခရက်ဒစ်သည် အချိန်ကာလ တစ်ခုအတွင်း အပြည့်အဝ ပြန်လည်ပေးချေရန် လိုအပ်ပြီး ထိုကာလအတွင်း ကျသင့်သည့် အတိုးနှုံးကိုလည်း ပေးချေရပါမည်။ ခရက်ဒစ် အမျိုးအစား ၄ ခု ရှိပါသည်။ လည်ပတ်ခရက်ဒစ်လိုင်း၊ အခကြေးငွေကတ်၊ အလုပ်အရင်းအနှီး ဝန်ဆောင်မှုခရက်ဒစ်နှင့် အရစ်ကျခရက်ဒစ်စသည်တို့ ဖြစ်ပါသည်။ သင်သည် ခရက်ဒစ်ကိုရပြီး အချိန်နှင့်အညီ ပြန်ဆပ်သည့်အခါ သင်၏ ခရက်ဒစ်ရမှတ်သည် တိုးတက်ကောင်းမွန်လာပြီး အချိန်ကြာလာသည်နှင့်အမျှ ထောက်ပံ့သူများထံမှ ပိုမိုချေးယူနိုင်သည့်အခွင့်အရေးကို ရရှိပါသည်။ သင်၏ ခရက်ဒစ်ရမှတ်ကို မကြာမကြာ စစ်ဆေးခြင်းဖြင့် ခရက်ဒစ်ရမှတ်၏ အခြေအနေ အပြောင်းအလဲကို ပုံမှန် သိရှိနေနိုင်ပါသည်။

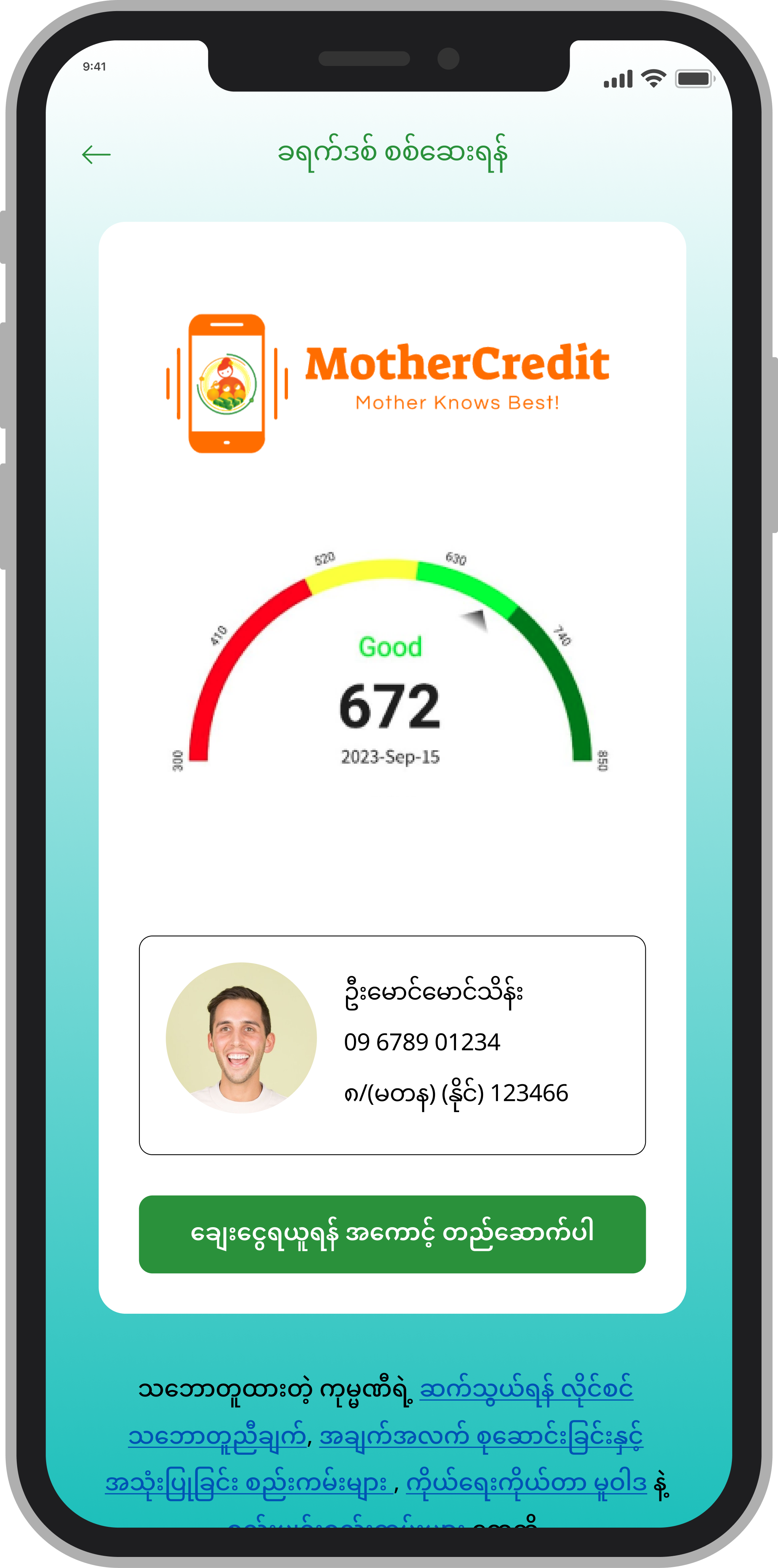

ကမ္ဘာပေါ်တွင် ခရက်ဒစ်အမှတ်ပေးစနစ်များစွာ ရှိပါသည်။ လူကြိုက်အများဆုံးများမှာ FICO၊ TransUnion နှင့် Vantage Score တို့ဖြစ်သည်။ MotherCredit® သည် ၎င်း၏ကိုယ်ပိုင် ခရက်ဒစ်အမှတ်ပေးစနစ်ကို အသုံးပြုပါသည်။ ခရက်ဒစ်ရမှတ်များသည် အညံ့ဖျင်းဆုံးရမှတ်အဖြစ် ၃၀၀ မှစတင်ကာ အကောင်းမွန်ဆုံးရမှတ်အဖြစ် ၈၅၀ အထိ ရှိနိုင်ပါသည်။ MotherCredit® ဖြင့် သင့်ခရက်ဒစ်ရမှတ်ကို စစ်ဆေးခြင်းသည် လွယ်ကူပြီး သင့်ခရက်ဒစ်၏စွမ်းဆောင်ရည်ကို ကြည့်ရှုရန် သုံးလတစ်ကြိမ် လုပ်ဆောင်နိုင်ပါသည်။

ဆိုးရွားသော ခရက်ဒစ်ရမှတ် - သင့်တွင် ဆိုးရွားသော ခရက်ဒစ်ရမှတ်ရှိပါက သင်သည် ခရက်ဒစ်ရမှတ်မှာ ၃၀၀ မှ ၄၉၉ကြားတွင် ရှိနေသည်ဟု ဆိုလိုသည်။ ဆိုးရွားသည့် ခရက်ဒစ်ရမှတ်ရှိခြင်းသည် ငွေချေးသူများထံမှ ခရက်ဒစ် ရ ယူနိုင်မှုအပေါ် သိသိသာသာ သက်ရောက်မှုရှိပါသည်။ မော်တော်ကားအတွက် ချေးငွေမှ စတင်၍ အတိုးနှုန်းသက်သာသော အကြွေးဝယ်ကတ် အထိ ရယူရန် အလွန်ခက်ခဲသွားပါ လိမ့် မည်။ မော်တော်ကားနှင့် အိမ်အတွက် အာမခံ ကျသင့်မှုများသည် အတိုးမြင့်နေနိုင်ပြီး ခရက်ဒစ်ရမှတ် ကောင်းသူများ ပြုလုပ်ရန်မလိုသည့် လျှပ်စစ်မီး၊ ရေ မီတာစသည်တို့အတွက် အပေါင်ငွေကြေး ပေးရခြင်းများလည်း ရှိလာနိုင်ပါသည်။ ဆိုးရွားသည့် ခရက်ဒစ်ရမှတ်တစ်ခုသို့ ကျဆင်းသွားခြင်းသည် များသောအားဖြင့် သင့်ခရက်ဒစ်ကတ် သို့မဟုတ် မော်တော်ကားချေးငွေအတွက် ဘေလ်အချို့ပေးချေရန် မေ့လျော့သွားသောအခါမျိုးတွင် ဖြစ်လေ့ရှိပါသည်။ သို့သော် ၎င်းသည် သင်၏ခရက်ဒစ်ရယူနိုင်မှုအတွက် လမ်းဆုံးမဟုတ်ပေ။ ထိုအခြေအနေမျိုးတွင် ဆိုးရွားသော သည့် ခရက်ဒစ်ရပ်တည်မှု အလိုက် မြင့်မားသောအတိုးနှုန်းဖြင့် ချေးငှားလိုသည့် ဝန်ဆောင်မှုပေးသူများကို ရှာဖွေနိုင်ပါသည်။ ထိုမှတဆင့် သင်၏ ပေးချေစရာရှိသည်များကို အချိန်မီ ဆက်လက်ပေးချေပါက သင်၏ ခရက်ဒစ်ရမှတ်သည် အချိန်နှင့်အမျှ ပြန်လည်တိုးတက်လာနိုင်ပါသည်။

သင့်တင့်သော ခရက်ဒစ်ရမှတ် - သင်၏ ခရက်ဒစ် ရမှတ်သည် ဆိုးရွားသော ရမှတ်နှင့် ကောင်းမွန်သောရမှတ်တို့ ကြားတွင် တည်ရှိနေပါက သင့်တင့်သော ခရက်ဒစ်ရမှတ်တွင် ရှိနေသည်ဟု နားလည်နိုင်ပါသည်။ ၎င်းသည် အများအားဖြင့် သင်သည် ခရက်ဒစ်ရမှတ် ၅၀၀ နှင့် ၅၉၉ အကြားတွင် ရှိနေသည်ဟု ဆိုလိုသည်။ ဤခရက်ဒစ်ရမှတ်တွင် သင့်အတွက် ဆိုးရွားသည့် ခရက်ဒစ်ရမှတ် ထက် ပိုမို ရွေးချယ်စရာများစွာ ရှိပါလိမ့်မည်။ ထိုကဲ့သို့ ခရက်ဒစ်ရမှတ်တွင် သင်သည် ပေါင်နှံမှုများနှင့် မော်တော်ကားချေးငွေများနှင့် အကြွေးဝယ်ကတ်များကို စတင်လျှောက်ထားနိုင်ပါသည်။ ထိုကဲ့သို့ အချိန်သည် ကောင်းမွန်သော ခရက်ဒစ်ရမှတ် သို့ ရောက်ရှိရန် ကြိုးပမ်းသင့်သည့် အကောင်းဆုံးအချိန် ဖြစ်ပါသည်။ ထိုမှတဆင့် အိမ်အပေါင်ခံခြင်း၊ ငွေချေးခြင်း နှင့် ခရက်ဒစ်ကဒ်များအတွက် ပိုမိုရွေးချယ်စရာများ လမ်းပွင့်လာစေပါလိမ့်မည်။

ကောင်းမွန်သောခရက်ဒစ်ရမှတ် - ကျွန်ုပ်တို့၏ MotherCredit® ခရက်ဒစ်ရမှတ် သတ်မှတ်မှု အရ ကောင်းမွန်သောခရက်ဒစ်ရမှတ်သည် ၆၀၀ မှ ၆၉၉ အတွင်းရှိပါသည်။ သင်၏ ခရက်ဒစ်ရမှတ်သည် 'ကောင်းမွန်သည့် ကိန်းဂဏန်း' အောက်သို့ရောက်နေပါက တိုး တက် ရန် အရေးကြီးသော လုပ်ဆောင်ချက်များကို လုပ်ဆောင်နိုင်ပါသည်။ ဦးစွာ သင်၏ ငွေတောင်းခံလွှာများကို အချိန်မီပေးချေပါ။ သင်၏ လက်ကျန်ငွေကို သတိထားကြည့်ရှုပါ၊ ခရက်ဒစ်အတွက် လျှောက်ထားခြင်းအား လွန်စာဆန္ဒမစောပါနှင့်။ သငတတ်နိုင်သောကုန်ကျစရိတ်ပမာဏအတွင်း နေထိုင်ပါ။ အကောင့်များကို ပေါင်းစပ်သုံးစွဲပါ။ ထို့နောက် အနာဂတ်ကို အာရုံပြုပါ။ဤခရက်ဒစ်မှတ်တမ်းများသည် အရေးပါပါသည်။ ကောင်းမွန်သောခရက်ဒစ်ရမှတ်ဖြင့် ခရက်ဒစ်ကတ်များ၊ မော်တော်ကားချေးငွေများနှင့် အိမ်ပေါင်နှံမှုများတွင် အလွန်ကောင်းသော အကျိုးခံစားခွင့်များ ရရှိပါလိမ့်မည်။

အလွန်ကောင်းမွန်သော ခရက်ဒစ်ရမှတ် - ကျွန်ုပ်တို့၏ MotherCredit® ခရက်ဒစ်ရမှတ်အရ ၇၀၀ နှင့်အထက် အနီးအနားတွင် ရှိနေပါက သင်သည် အလွန်ကောင်းမွန်သော ခရက်ဒစ်တွင် ရှိနေပါသည်။ ခရက်ဒစ်ရမှတ် သဘောတွင် ဤပမာဏသို့ရောက်ရှိသည်ဆိုသည်မှာ သင်၏ငွေပေးချေမှုမှတ်တမ်း၊ အကြွေးအသုံးပြုမှု၊ ခရက်ဒစ်သက်တမ်း၊ ခရက်ဒစ်ပေါင်းစပ်မှုနှင့် စုံစမ်းမေးမြန်းမှုများသည် ပြီးပြည့်စုံသော (သို့မဟုတ်) အလွန်ကောင်းမွန်သော ဘဏ္ဍာရေးအခြေအနေတွင် ရှိနေသည်ဟု ဆိုလိုသည်။ ကောင်းမွန်သောခရက်ဒစ်ရမှတ် ရှိနေခြင်းသည် ထိပ်တန်းအကြွေးဝယ်ကတ်ကမ်းလှမ်းမှုများ၊ အကောင်းဆုံးသောအတိုးနှုံးဖြင့် ချေးငွေများ နှင့် ငွေချေးသူများကပေးသော အခြားကမ်းလှမ်းချက်များဆီသို့ လမ်းကြောင်းပွင့်စေပါသည်။ သို့သော် ထိုသို့ ကောင်းမွန်သော ခရက်ဒစ်ရမှတ်တွင် ရှိနေခြင်းကြောင့် သင့်၏ ခရက်ဒစ်တည်ဆောက်မှု ပြီးဆုံးပြီဟု မသတ်မှတ်သင့်ပါ။ အထူးသဖြင့် သင်၏ ခရက်ဒစ်ရမှတ်သည် ကောင်းမွန်သော ခရက်ဒစ်ရမှတ် အပိုင်းအခြား၏ အနိမ့်ပိုင်းတွေ ရှိနေလျှင် ပို၍ မယူဆသင့်ပါ။ သင့်ခရက်ဒစ်ကို စဉ်ဆက်မပြတ် မြှင့်တင်နေရန် အကြံပြုပါသည်။

သင်၏ ခရက်ဒစ်ရမှတ်ကို MotherCredit® ဖြင့် စစ်ဆေးခြင်းသည် ပေါ့ပေါ့ပါးပါး ခရက်ဒစ်စစ်ဆေးချက်ဖြစ်ပြီး ရေရှည် အကျိုးသက်ရောက်မှု ခရက်ဒစ် စစ်ဆေးချက် မဟုတ် သည့်အတွက် သင်၏ နဂိုရှိနေသည့် ခရက်ဒစ်ရမှတ်အပေါ် သက်ရောက်မှုမရှိစေပါ။ ပေါ့ပေါ့ပါးပါး ခရက်ဒစ်စစ်ဆေးမှုကို ပြုလုပ်သည့်အခါတွင် သင်သည် ခရက်ဒစ်ရမှတ်ကို သိရှိရန်သာ စစ်ဆေးခြင်း သာ ဖြစ်ပြီး ချေးငွေလျှောက်ထားခြင်း သို့မဟုတ် ငွေကြေးအရ ဝင်ရောက်ခွင့် အမျိုးအစား တစ်ခုခု ခွင့်ပြုရန် မျှော်လင့်ထားခြင်းကြောင့် စစ်ဆေးခြင်း မဟုတ်ပါ။ သင်၏ သင့်ဘဏ္ဍာရေး��အခြေအနေကို ဆုံးဖြတ်ရာတွင် အကူအညီရရန်အတွက် Mother Finance မိုဘိုင်းအပလီကေးရှင်း မှတစ်ဆင့် ခရက်ဒစ်စစ်ဆေးမှုကို တစ်နှစ်လျှင် လေးကြိမ်ခန့်ပြုလုပ်နိုင်ပါသည်။

သင့်ခရက်ဒစ်ရမှတ်ကို ထိခိုက်စေနိုင်သော အချက်အချို့များမှာ သင်၏ အကြွေးပြန်ဆပ်မှု မှတ်တမ်း၊ ခရက်ဒစ် သုံးစွဲမှုနှုန်း၊ ခရက်ဒစ် သက်တမ်း၊ ချေးငွေအမျိုးအစားများနှင့် သင့်အကောင့်တွင် ရှိသည့် ခရက်ဒစ် စုံစမ်းမေးမြန်းမှု အကြိမ်ရေတို့ ဖြစ်သည်။ ထို့အပြင်ခရက်ဒစ်ရမှတ် စုံစမ်းမေးမြန်းမှု အမျိုးအစားသည်လည်း ပိုအရေးကြီးပါသည်။ MotherCredit® မှလုပ်ဆောင်သော ရိုးရှင်းသည့် ပေါ့ပေါ့ပါးပါး ခရက်ဒစ်စစ်ဆေးမှုတစ်ခုသည် သင့်ခရက်ဒစ်ရမှတ်ကို ထိခိုက်မည်မဟုတ်ပါ။

သင်၏ ခရက်ဒစ်ရမှတ်သည် အချိန်ကာလာနှင့်အမျှ တဖြည်းဖြည်း ပြောင်းလဲနေသောကြောင့် ခဏခဏစစ်ဆေးရန် အကြံမပြုပါ။ ပိုမိုသိသာထင်ရှားသော တိုးတက်မှု သို့မဟုတ် ကျဆင်းမှုကို မြင်တွေ့ရန် အခါအားလျော်စွာ စစ်ဆေးခြင်းသည် အသင့်လျော်ဆုံးဖြစ်ပါသည်။ ပုံမှန်အားဖြင့် ခရက်ဒစ်ရမှတ်တို့သည် နေ့ချင်းညချင်း မပြောင်းလဲပါ။ MotherCredit® ၏ ခရက်ဒစ်စစ်ဆေးခြင်းကို Mother Finance Mobile App မှတစ်ဆင့် တစ်နှစ်လျှင် လေးကြိမ်အထိ ပြုလုပ်နိုင်ပါသည်။

ဖြစ်နိုင်လျှင် သင်၏အကြွေးအားလုံးကို အချိန်မီပေးချေရန် ကြိုးပမ်းအားထုတ်ပါ။ ထိုသို့ပေးချေခြင်းက သင့်ခရက်ဒစ်ရမှတ် အဆင့်သတ်မှတ်ချက်ကို မြှင့်တင်ပေးရုံသာမက ကျဆင်းသွားခြင်းမျိုး မရှိ အောင်လည်း ကာကွယ်ပေးနိုင်ပါသည်။ ငွေတောင်းခံလွှာများကို အချိန်မီမပေးချေခြင်းသည် နောက်ကျငွေပေးချေမှုအဖြစ် သတ်မှတ်ခံရနိုင်ပြီး သင့်ခရက်ဒစ်ရမှတ်ကို ကျဆင်းရန် သက်ရောက်မှု ရှိနိုင်ပါသည်။ သင့်ကြွေးမြီများကို အချိန်မီ ပေးချေခြင်းသည် ပိုမိုကောင်းမွန်သော အတိုးနှုန်းဖြင့် ချေးငွေများနှင့် အခြားဆွဲဆောင်မှုရှိသော ဘဏ္ဍာရေးကမ်းလှမ်းမှုများအတွက် လမ်းပွင့် စေပါသည်။ သင့်ငွေတောင်းခံလွှာများကို ပေးဆောင်ရန် သတိပေးချက်များ သတ်မှတ်ထားခြင်းဖြင့် မေ့လျော့ခြင်းမျိုး မဖြစ်စေရန် စီစဥ်ထားသင့်ပါသည်။

ချေးငွေ သို့မဟုတ် ခရက်ဒစ်ကတ်တွင် ပေးချေမှုတစ်ခု ပြန်မပေးချေလိုက်ပါက နောက်ကျလိုက်ပါက သင်၏ ခရက်ဒစ်ရမှတ် ကျဆင်းရန် အကျိုးသက်ရောက်မှုများ ရှိလာမည်ဖြစ်ပါသည်။ သင်၏ ဘေလ်များကို အချိန်မီ ပေးချေရန် သင့်ကိုယ်သင် သတိပေးချက်များ သတ်မှတ်ထားရှိရန် အရေးကြီးပါသည်။ မဟုတ်ပါက သင်၏ ခရက်ဒစ်ရမှတ်သည် ကျဆင်းသွားနိုင်ပြီး ချေးငွေအသစ်များရနိုင်မှုကို ကန့်သတ်သွားစေနိုင်ပါသည်။ အချိန်မီချေးငွေပြန်ဆပ်ခြင်းသည် သင့်အတွက် အမြဲတမ်း ဦးစားပေး သင့်ပါသည်။ ငွေပေးချေရန် ရက်အနည်းငယ်နောက်ကျခြင်းမျိုးသည် အလွန် အရေးမကြီးသော်လည်း ငွေပေးချေမှုနောက်ကျလွန်းပါက သင်၏ခရက်ဒစ်ရမှတ် ကျဆင်းရန် သက်ရောက်မှုရှိမည်ဖြစ်သည်။ နောက်ကျလွန်းခြင်း၏ အခြားအကျိုးဆက်များမှာ နောက်ကျကြေးပေးဆောင်ရခြင်းနှင့် သင့်အကောင့်တွင် အတိုးနှုန်းများ ပိုတိုးပေးရခြင်းတို့ ဖြစ်လာနိုင်ပါသည်။ သင့်ငွေတောင်းခံလွှာများကို အချိန်မီမပေးဆောင်ခြင်းက အကြွေးတောင်းခံရခြင်းနှင့် အကြိမ်ကြိမ်အဆုံးသတ်စေနိုင်ပါသည်။ ဥပမာအားဖြင့် သင်သည် ဆေးဘက်ဆိုင်ရာ ဘေလ် သို့မဟုတ် အကြွေးဝယ်ကတ် သို့မဟုတ် အရစ်ကျချေးငွေဖြစ်စေ အကြွေးတစ်ခုခုတွင် ပုံမှန်ပေးဆပ်နိုင်မှု မရှိပါက ဆုံးရှုံးသွားသောအကြွေးကို ပြန်လည်ရယူရန် ကြိုးစားမည့် အကြွေးတောင်းအေဂျင်စီတစ်ခုခုနှင့် ရင်ဆိုင်ရနိုင်ပါသည်။ ထိုသို့ဖြစ်လာပါက သင်၏ အမည်သည် ခရက်ဒစ်ဗျူရို၏ အမည်ပျက်စာရင်းတွင် ပါဝင်သွားနိုင်ပါသည်။

ရှင်းလင်းချက် :

လူတစ်ဦးစီ၏ ခရက်ဒစ်အခြေအနေသည် မတူညီကြပါ။ ခရက်ဒစ်ရမှတ်များသည် ကွဲပြားနိုင်ပြီး MotherCredit® သည် မည်သည့်ခရက်ဒစ်ရမှတ်ကိုမျှ အာမခံချက်မပေးနိုင်ပါ။ Mother Finance မိုဘိုင်းအပလီကေးရှင်းရှိ အချက်အလက်များသည် ယေဘူယျအထောက်အထားသက်သေအချက်အလက်ဆိုင်ရာ အတွက်သာ ရည်ရွယ်ပြီး ဥပဒေ၊ အခွန်၊ စာရင်းကိုင်မှတ်တမ်းဇယား သို့မဟုတ် ပရော်ဖက်ရှင်နယ်အကြံပေး ချက်အဖြစ် ယူဆ၍မရနိုင်ပါ ။ ထို့ကြောင့် ကျွန်ုပ်တို့မှ ထုတ်ပေးသည့် ခရက်ဒစ်ရမှတ်ကို ပရော်ဖက်ရှင်နယ် ဥပဒေ၊ အခွန်၊ စာရင်းအင်းမှတ်တမ်းဇယား စသည်တို့တွင် အစားထိုးအဖြစ် အသုံးမပြုသင့်ပါ။ ဤမိုဘိုင်းအပလီကေးရှင်းရှိ အချက်အလက်အားလုံးကို လက်ရှိလျှပ်တစ်ပြက် မျက်မြင်အတိုင်း သာ သုံးသင့်ပြီး ပြည့်စုံမှု၊ တိကျမှု၊ အချိန်မီမှု တို့အတွက် အာမ မခံပေးနိုင်ပါ။ MotherCredit® ၏လုပ်ငန်းခွဲများ၊ သို့မဟုတ် ၎င်းတို့၏ အေးဂျင့်များ သို့မဟုတ် ဝန်ထမ်းများသည် ဤမိုဘိုင်းအပလီကေးရှင်းရှိရှိ အချက်အလက်အပေါ် ကိုးကား၍ ပြုလုပ်ထားသော ဆုံးဖြတ်ချက် သို့မဟုတ် လုပ်ဆောင်မှုများအတွက် သင့် သို့မဟုတ် အခြားမည်သူ့ကိုမျှ တာဝန်ယူမည်မဟုတ်ပါ။ “တွဲဖက်ဆက်စပ်မှု” ဆိုသည်မှာ တိုက်ရိုက် သို့မဟုတ် သွယ်ဝိုက်၍ ပိုင်ဆိုင်သောသို့မဟုတ် ထိန်းချုပ်ခြင်း၊ ပိုင်ဆိုင်ခြင်း၊ ဘုံပိုင်ဆိုင်မှု သို့မဟုတ် ဘုံထိန်းချုပ်မှုအောက်တွင် ရှိနေသော မည်သည့်အဖွဲ့အစည်းကိုမဆို ဆိုလိုသည်။ အသုံးပြုသူ တစ်ဥိးစီ၏ ခရက်ဒစ်ရလဒ် အခြေအနေသည် ပြောင်းလဲနေနိုင်သည် ဖြစ်သည့်အတွက် MotherCredit® သည် ၎င်း၏ ဝန်ဆောင်မှု တစ်ခုခုမှ ရရှိသည့် ခရက်ဒစ်ရလဒ် တစ်ခုခုအတွက် အာမခံချက် မရှိပါ။ အချိိန်ကာလတစ်ခုအတွင်း ခရက်ဒစ်ရလဒ် တစ်ခုခု ရရှိရန်အတွက်ကိုလည်း အာမခံချက် မရှိကြောင်းကို သတိပြုရန်အရေးကြီးပါသည်။