Mother Finance

Making Credit Accessible For Your Everyday Financial Well-Being

Low Interest | Fixed Term | Reliable Credit

Quick

Easy

Transparent

Secure

About

Mother Finance Co., Ltd. (Registration No. 101001296) is incorporated in the Republic of the Union of Myanmar and licensed as a non-bank financial institution (NBFI/FC(R)-11/08/2016).

Mother Finance Today<>

We provide consumer loans through our digital lending mobile application that automates underwriting process in real time using thousands of alternative data signals. Anyone with a smart phone in Myanmar can apply for an unsecured loan and receive a quick credit decision, regardless of their financial history. We offer fast, easy and customized loans to borrowers and help them access to finance, build digital credit histories, or financial identities, over time.

Our Mission Always

We’re committed to building a world where underserved people everywhere have financial access, knowledge, choice, and control. People need access to financial products and services, including credit and all the opportunity credit brings. Within the array of financial products and service offerings, they need to have the right tools, information and knowledge to make informed choices, so they can do what they wish to do, what they need to do, and what they should do with their money and income. Finally, we want more people everywhere in Myanmar to be in control of their finances, as active participants in their own financial lives — whether they are budgeting, learning, saving, or investing.

Get Started

How It Works

Your Personal Loan, Tailored for You.

Emergency cash needs? Paying for a large expense like a computer, home renovation or a special occasion? We have you covered.

Get a Low Rate

Pay at Your Own Pace

Save Money

Help Center

Questions? We have answers

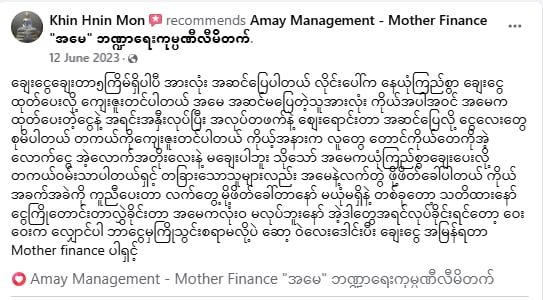

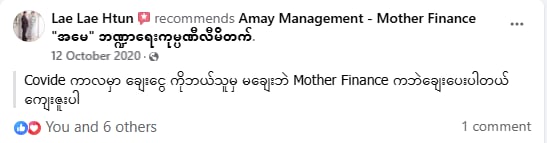

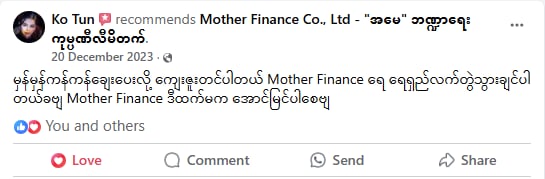

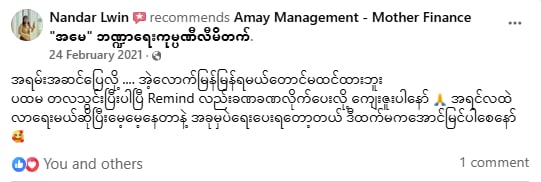

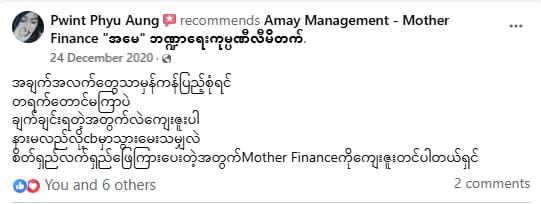

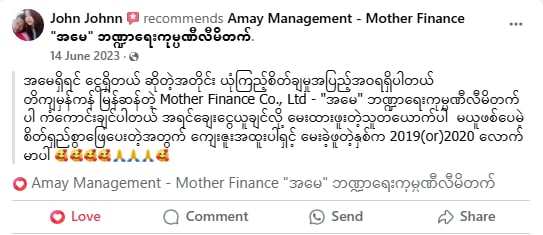

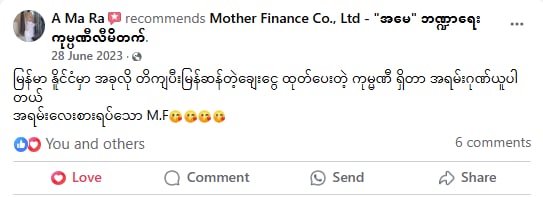

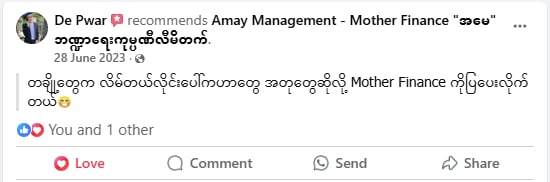

Reviews

Contact Us